RRSP vs TFSA

RRSP vs TFSA: What Every Canadian Should Know Before Investing

“Confused about RRSPs and TFSAs? Learn the key differences between these two Canadian investment accounts — how they work, when to use each, and how to make them part of your long-term wealth strategy.”

Introduction: Two Powerful Tools for Canadian Wealth-Building

What’s the Difference Between a TFSA and an RRSP?

The Max-Out-Your-TFSA-First Strategy

1. Tax-Free Growth Compounds Over Decades

2. Withdrawals Are Flexible and Tax-Free

3. You Keep the Growth and Avoid the Tax Hit

4. When to Switch Focus to RRSPs

“RRSPs are only for retirement.”

“You lose your TFSA room if you take money out.”

“You can only have one TFSA or one RRSP.”

How to Decide Which One to Use First

Introduction: Two Powerful Tools for Canadian Wealth-Building

If you’ve ever wondered whether you should put your money into an RRSP or a TFSA, you’re not alone. Many Canadians feel confused about these two investment accounts — and end up doing nothing out of fear of making the wrong choice.

But here’s the truth: both are incredible tools for building wealth. The key is understanding how and when to use them to your advantage.

At Wise & Wealthy, we believe financial confidence comes from knowledge — not luck or guesswork. Let’s break it down in plain English.

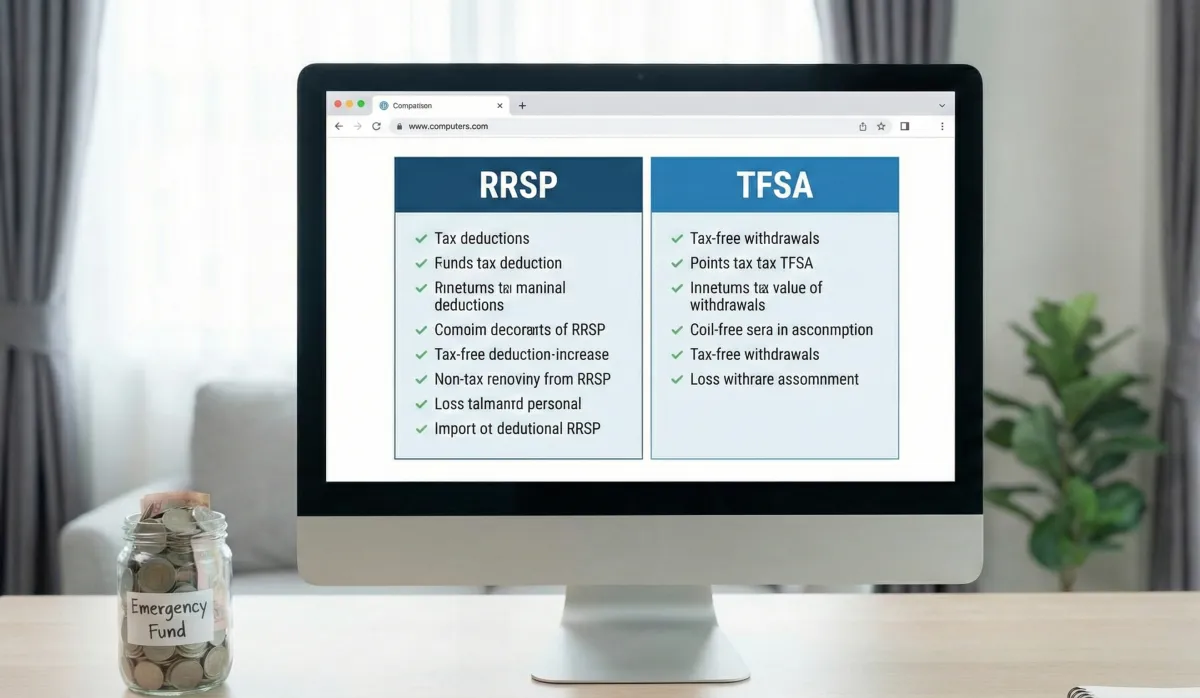

What’s the Difference Between a TFSA and an RRSP?

In short:

TFSA = flexibility + tax-free growth

RRSP = tax savings now + tax later

Both accounts can hold the same investments — like GICs, mutual funds, ETFs, or stocks. The difference is how they’re taxed.

When a TFSA Makes More Sense

If you’re early in your career or in a lower income bracket (under roughly $60,000/year), a TFSA often makes more sense.

Why? Because you won’t benefit much from the RRSP tax deduction now — and you’ll appreciate tax-free withdrawals later.

Example:

Let’s say you’re earning $45,000/year and invest $5,000.

In a TFSA, you pay no tax on the growth or withdrawals.

In an RRSP, you’d save a small amount in taxes now but pay full income tax on withdrawals later — often at a higher rate.

Best for:

- Building an emergency fund that earns interest

- Saving for a home or vehicle

- Investing for long-term goals with flexibility

The Max-Out-Your-TFSA-First Strategy

One of the smartest long-term strategies — especially for younger Canadians — is to maximize your TFSA before contributing to an RRSP.

Here’s why:

1. Tax-Free Growth Compounds Over Decades

Every dollar you invest in a TFSA grows completely tax-free — forever.

That means if you invest $6,000/year for 30 years and earn an average return of 6%, you’ll have:

Over $500,000 — all tax-free on withdrawal.

If that same money were in an RRSP, it might grow to a similar amount, but you’d owe taxes when withdrawing it in retirement — which could easily take away 20–30% depending on your income at the time.

2. Withdrawals Are Flexible and Tax-Free

Unlike an RRSP, withdrawing money from your TFSA doesn’t trigger taxes or reduce government benefits like OAS (Old Age Security) or GIS (Guaranteed Income Supplement).

That flexibility means you can:

Use your TFSA as a retirement supplement

Withdraw funds for travel, emergencies, or large purchases

Reinvest your withdrawal amount the following year

This freedom gives you far more control over your money — especially in retirement when every tax dollar counts.

3. You Keep the Growth and Avoid the Tax Hit

When you withdraw from your RRSP in retirement, every dollar is taxed as income.

That can bump you into a higher tax bracket or reduce government benefits.

With a TFSA, you keep every penny of your growth.

Example:

Let’s say by retirement, your TFSA holds $400,000, and your RRSP holds $400,000.

With a TFSA: You withdraw $20,000/year — tax-free.

With an RRSP: You withdraw $20,000/year — but you might pay $4,000–$6,000 in taxes, depending on your bracket.

Over 20 years, that’s potentially $80,000–$120,000 saved in taxes just by prioritizing your TFSA growth first.

4. When to Switch Focus to RRSPs

Once you’ve maximized your TFSA contribution room (as of 2025, that’s roughly $95,000 total lifetime room if you were 18 or older in 2009), it’s smart to start building your RRSP — especially if your income has grown and you can benefit from the immediate tax deduction.

This way, you:

Build a tax-free investment base (TFSA) for long-term flexibility

Build a tax-deferred base (RRSP) for structured retirement income

Reduce your taxable income during your high-earning years

In combination, these two accounts can form a powerful, balanced retirement plan.

When an RRSP Shines

If you’re in a higher income bracket, an RRSP becomes a powerful tool.

Each dollar you contribute reduces your taxable income — meaning a lower tax bill today. Then, ideally, you’ll withdraw the money in retirement when you’re in a lower tax bracket.

Example:

If you earn $90,000/year and contribute $10,000 to your RRSP, you could get back around $3,000–$3,500 in tax savings, depending on your province.

Best for:

- Reducing taxes during high-earning years

- Saving for retirement

- Using the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP)

RRSP & TFSA Myths — Busted

“RRSPs are only for retirement.”

Not true! You can also borrow from your RRSP for a down payment (under the Home Buyers’ Plan) or to go back to school (through the Lifelong Learning Plan).

“You lose your TFSA room if you take money out.”

Nope! You get that contribution room back the next calendar year.

“You can only have one TFSA or one RRSP.”

You can open multiple accounts at different banks — but your total contributions must stay within your yearly limits.

How to Decide Which One to Use First

Here’s a simple decision guide:

Pro Tip: Many Canadians use both.

Start with your TFSA to build liquidity and flexibility, then add RRSP contributions as your income (and tax rate) rises.

Common Mistakes to Avoid

Withdrawing RRSP funds too early.

It triggers withholding tax and adds to your taxable income. Avoid unless absolutely necessary.Forgetting to reinvest your tax refund.

The refund from your RRSP contribution isn’t “extra money” — it’s your own money returned. Reinvest it!Leaving your TFSA as cash only.

It’s called a Tax-Free Savings Account, but it can (and should) hold investments for long-term growth.

How This Fits into Your Financial Foundation

Both the RRSP and TFSA are tools in your long-term wealth-building strategy — not standalone solutions.

At Wise & Wealthy, we teach that investing comes after you’ve:

- Built an emergency fund

- Paid down debt

- Created a sustainable spending plan

Once those foundations are solid, these registered accounts become your growth engine — helping your money compound over time.

Conclusion: Your Future, Your Strategy

You don’t need to be a financial expert to make smart decisions with your money.

Start simple: open one account, automate small contributions, and let time do the heavy lifting.

Every dollar invested intentionally is a step closer to freedom and flexibility.

CTA: Ready to learn how to build long-term wealth with confidence? Join our Financial Foundations Course and start investing in your future today. Link to course! 👈

DISCLAIMER - this is not investment advice and is to be used strictly for educational purposes. Please consult a licensed Financial Advisor to help you with your investing decisions!